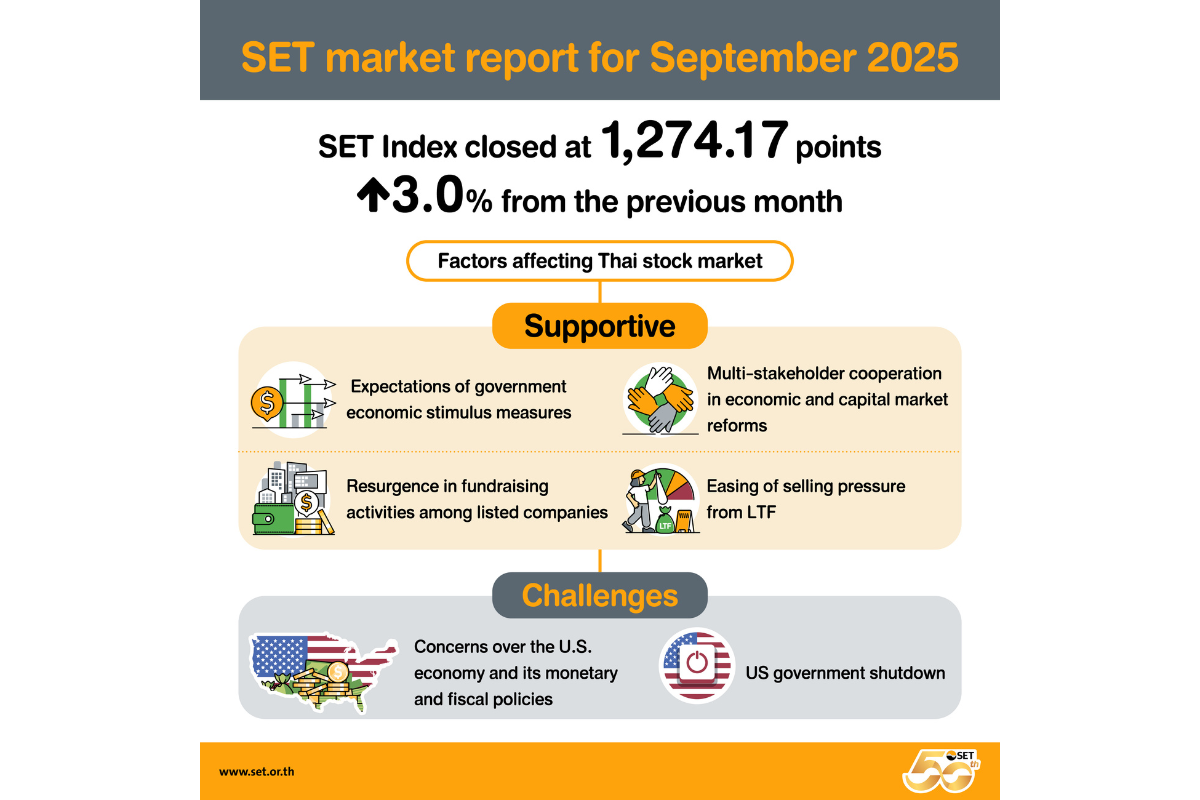

The Stock Exchange of Thailand (SET) Index closed at 1,274.17 points in September 2025, up 3.0% from the previous month, driven by investor expectations of government economic stimulus measures that bolstered the Thai stock market. Meanwhile, concerns over the U.S. economy and its monetary and fiscal policies led global investors to increase their holdings in safe-haven assets, particularly gold, the price of which surged to record highs in global markets. Regarding the U.S. government shutdown, which has occurred multiple times in the past and typically been short-lived, investors remained largely unfazed by the situation. This was reflected in the resilience of the U.S. stock market, which did not decline significantly during the period.

SET Senior Executive Vice President Soraphol Tulayasathien said that the U.S. government shutdown is expected to have limited impact on the SET Index, as investors largely perceive it as a temporary external factor that may create short-term volatility in capital flow. More significant factors to watch include the new government’s policy execution focused on “short-term stimulus, long-term gains, broad distribution” through the “Quick Big Win” initiative, alongside multi-stakeholder cooperation in economic and capital market reforms. The SET Index is expected to continue its recovery through the remainder of 2025, supported by a resurgence in fundraising activities among listed companies in both debt and equity markets over the past two months, while strong first-day performance of newly listed securities reflects improving investor sentiment and selling pressure from Long-term equity funds (LTF) has begun to ease.

Key highlights for September 2025

- At the end of September 2025, the SET Index increased 3.0 percent MoM to close at 1,274.17 points, narrowing the YTD decrease to 9.0 percent. Compared to the end of 2024, industry groups that outperformed the SET Index were Technology, Financials, Industrials, Resources, and Property & Construction.

- SET’s and Market for Alternative Investment (mai)’s average daily trading value dropped 31.0 percent YoY to THB 43.16 billion (approx. USD 1.34 billion), with the first nine months average daily trading value of THB 43.03 billion,

- Foreign investors sold a net THB 11.86 billion, with THB 96.24 billion in net selling for the January-September period of 2025.

- Foreign investors continued to dominate trading activity, accounting for 47.06 percent of the month’s total trading value. Retail investors represented 37.63 percent, up from 33.98 percent in the preceding month.

- There was one newly listed company on SET: Ngernturbo Plc (TURBO) and another one on mai: SKIN Laboratory Pcl (SKIN).

- SET’s forward P/E ratio at the end of September 2025 was 13.9 times, below the Asian stock markets’ average of 14.1 times. The historical P/E ratio stood at 14.7 times, lower than the Asian stock markets’ average of 16.0 times.

- Dividend yield ratio at the end of September 2025 was 3.86 percent, higher than the Asian stock markets’ average of 3.02 percent.

Derivatives Market

- At the end of September 2025, Thailand Futures Exchange (TFEX)’s daily trading volume averaged 457,290 contracts, up 23.7 percent from the previous month largely due to the higher trading volume of Single Stock Futures, Gold Online Futures, and Currency Futures. The YTD average daily trading volume in 2025 was 423,887 contracts, down 12.4 percent due to the decline in trading volume of Single Stock Futures and Gold Online Futures.