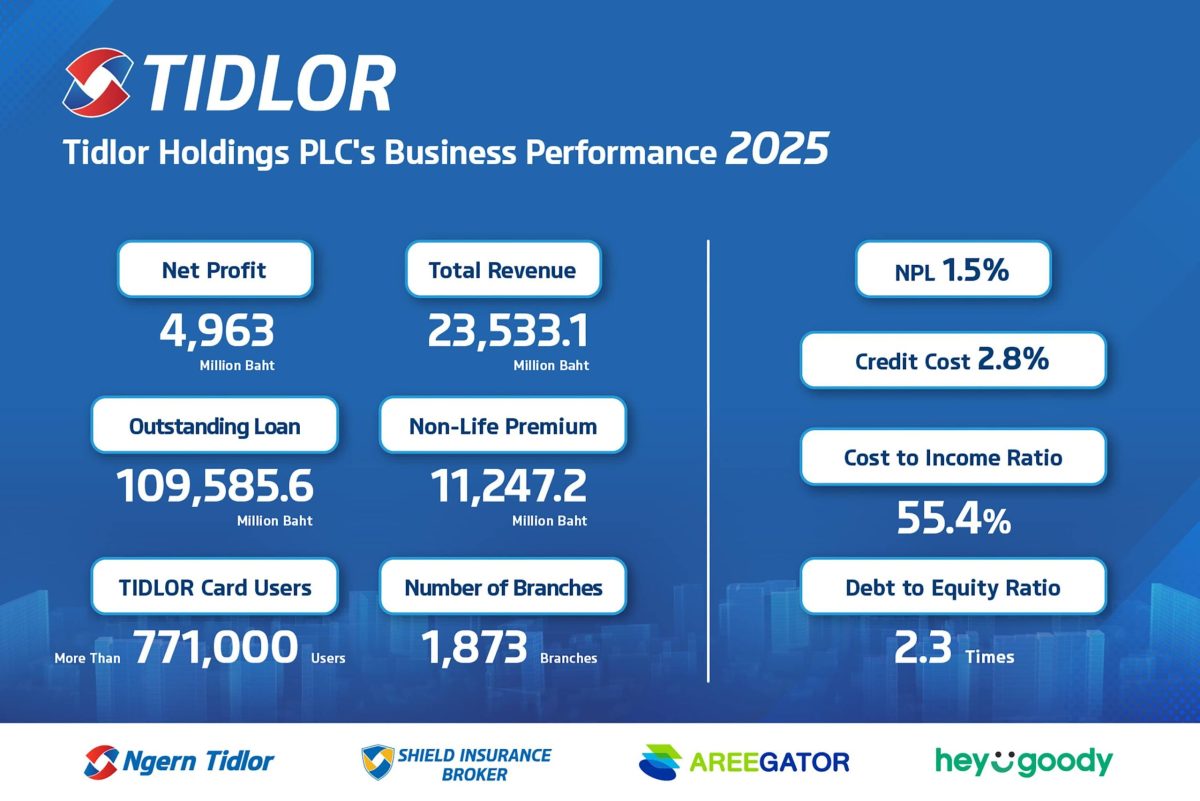

Tidlor Holdings Public Company Limited (“TIDLOR” or the “Group”) announced its successful operating results for 2025. Ms. Cholthicha Thongthai, Chief Financial Officer (CFO), stated that the Group achieved a record high net profit of 4,963 million baht, increasing 17.4% YoY. This success was driven by the company’s strategic focus on quality growth in both its vehicle title loan business and insurance brokerage business, alongside prudent credit quality and cost management. In 2025, the Group’s total revenue amounted to 23,533.1 million baht, rising 6.2% YoY, primarily supported by interest income growth in line with portfolio expansion, as well as fee and service income from the insurance brokerage business, which remains one of the Group’s key revenue sources. Additionally, the Group continued to expand its customer base across both businesses through diverse distribution channels (Omni-Channel). By the end of 2025, TIDLOR operated a total of 1,873 branches nationwide.

In the loan business, as of 2025, the Group’s outstanding loan portfolio totaled 109,585.6 million baht, growing 5.4% YoY and 2.1% QoQ. The key driver was the continued expansion of the vehicle title loan customer base through the nationwide network of Ngern Tidlor branches. Additionally, the Group has been strongly supported by the integration of technology to enhance financial services, including the Tidlor Card and the E-Withdrawal feature on the NTL application, both of which have seen steadily increasing usage. These innovations have improved customer convenience in accessing funds, and over the long term, contributed positively to the Group’s operating cost efficiency. Amid continued portfolio growth, the Group maintained effective credit quality management, resulting in a reduction of the Non-Performing Loan (NPL) ratio to 1.5% in 2025, down from 1.8% the previous year. Meanwhile, the credit cost ratio in 2025 stood at 2.8%, decreasing from the prior year, due to a lower net write-off level. This aligns with the prudent underwriting practices, effective debt collection, and the continuous improvement of overall loan portfolio quality throughout the year.

In the insurance brokerage business, the Group’s total non-life insurance premiums amounted to 11,247.2 million baht in 2025, increasing 10.5% YoY. This growth was driven by the comprehensive services catering to all customer segments through three main channels: the “Shield Insurance Broker”, the leading face-to-face insurance brokerage brand with over 5,000 licensed staff providing close customer services via Ngern Tidlor branches nationwide; the strength of the InsurTech platform, which supports services through the “Areegator” brand, an online insurance brokerage platform for agent networks, and the “heygoody.com”, a fully digital insurance brokerage platform offering a seamless 24/7 self-purchase experience.

For the fourth quarter of 2025, despite the challenging economic and social conditions, including the floods in Southern Thailand and international conflicts, the Group reported a net profit of 1,038.5 million baht. The Group continued to operate with prudence and discipline in line with the prevailing circumstances and additional provisions to accommodate uncertainties, ensuring business stability amidst the ongoing uncertain environment.

Mr. Piyasak Ukritnukun, Managing Director of Tidlor Holdings, stated, “We would like to thank our shareholders for their continued confidence and trust in Tidlor Holdings. The year 2025 was another successful year, as we delivered a remarkable 17.4% YoY increase in net profit. We achieved strong performance in both the insurance brokerage business, which significantly outperformed the overall non-life insurance market, and our lending business, which continued to grow even as most other operators experienced contraction. Both NPL and credit costs decreased, while costs continued to improve. These achievements reflect the success of our investments in building a solid business foundation across multiple dimensions, including our people, organizational culture, and technology capabilities. Additionally, last year, Tidlor Holdings strengthened its financial position by receiving an A+ credit rating from TRIS and an A- rating from JCR, a leading Japanese rating agency. This makes Tidlor Holdings the first non-bank financial group in Thailand to receive an Investment Grade rating from JCR, reinforcing our financial strength and credibility. Finally, I would like to assure our shareholders and investors of our confidence in both our current performance and our continued journey forward.”

Tidlor Holdings remain steadfast in their vision to become The Leading Financial Inclusion Service Provider, empowering underserved Thais with fair, transparent, and accessible financial solutions that enhance their quality of life. For shareholders and investors, more information is available at www.tidlorinvestor.com

Symbol: TIDLOR